Question: What kind of shoes does an optometrist wear?

Answer: “Seeing eye” shoes. Really. This is what my optometrist was wearing at my appointment.

Question: What kind of shoes does an optometrist wear?

Answer: “Seeing eye” shoes. Really. This is what my optometrist was wearing at my appointment.

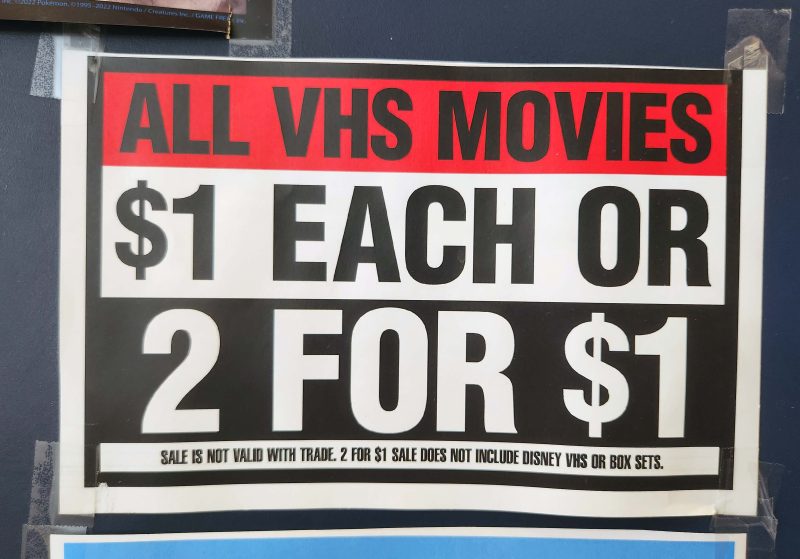

At first glance, this seems like a no-brainer, but I think it means that Disney movies and box sets are $1 each while all other movies are 2 for $1.

It’s amazing to hear the creative ideas people come up with to pass the time. Guinness World Records was approached by Fire & Smoke, a restaurant sponsor of the Jacksonville Jaguars, to document a world record for throwing a hot dog into a bun. To set the record: (1) the hot dog had to be thrown a minimum of 20 meters (65.62 feet); (2) the hot dog could not be tampered with in any way to aid its projection; and (3) the bun had to be pre-sliced.

The challenge took place on November 27, 2018. (Why didn’t we hear about this sooner?) Mark Brunell, the quarterback for the Jaguars at that time, was the thrower. “Everyone can throw a football,” he said, “and everyone can throw a hot dog.” The catcher was Ryan Moore, a British flat racing jockey. This photo–presumably taken from the catcher’s position–gives some perspective of the throwing distance. Note the cheerleaders and the team mascot on the left.

Here’s the throw . . .

. . . and the catch. Author’s query: There’s a hot dog on the ground. Was a previous throw a miss?

You can see the Guinness World Records stamp of approval in the lower right corner of the photo below. The distance thrown was 20.96 meters (68.76 feet). “It took just about everything I had to throw it that far,” said Brunell. “It’s a pretty big deal and I’m very proud of that.”

According to Guinness World Records, record challengers have the option of adding condiments to the hot dog. Go on, give it a try.

P.S. You can see a video of this awesome event on YouTube.

Why, oh why do women’s pants have pockets too small to carry a cell phone (it falls out of the pocket if I bend over, and the back pockets aren’t any deeper), . . .

but women’s pajamas have three pockets–one on the top and two in the pants–large enough for a cell phone or even an 8-inch tablet?

What do I need to put in a pocket to keep me uncomfortable all night while I sleep?

I saw this truck when I stopped for a red light.

I couldn’t tell what kind of rescues Super Dave performs, so I looked him up online. He’s a handyman. The attitude displayed on his truck makes me want to call him when I need something handy done.

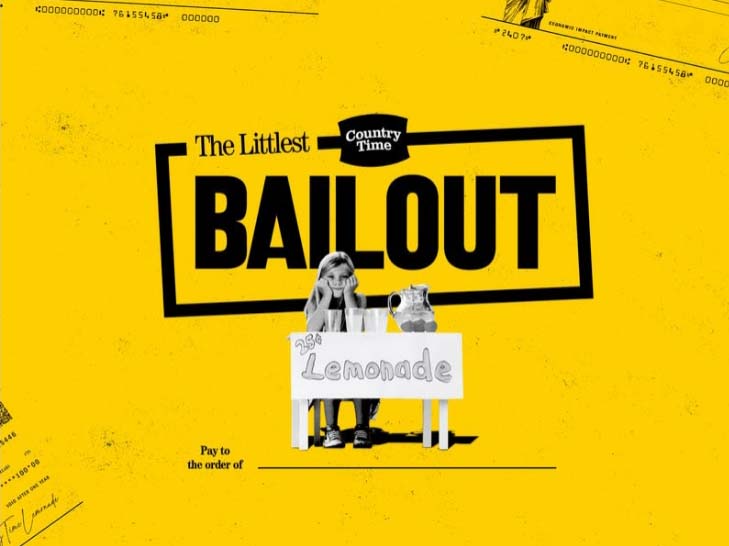

According to Country Time lemonade, kids’ lemonade stands across the nation are closed “due to social distancing guidelines.” To help the kids, Country Time launched the “Littlest Bailout Relief Fund” to help put a “little juice back into the economy.” It will send stimulus checks to kids who can’t operate their lemonade stands this summer. In a company news release, Country Time said it wants to ensure that even the smallest businesses can keep their dreams alive, “So when life gives you social distancing, make lemonade.”

Through August 12, parents of children 14 years old or younger can apply for a chance to win $100 in Visa gift cards and a commemorative check. (Interested? Go to www.countrytimebailout.com).

In 2018, Country Time had a “Legal Ade” promotion to help kids pay permit fees on their lemonade stands, due to outdated permit laws. This prompted several states to exclude lemonade stands from businesses that require a permit to operate.

We scored today at Wal-Mart.

There was a limit of one each, but it wasn’t clear if a package of one roll of paper towels and a package of six rolls of paper towels were equally counted as one item. A small-size package of each item was sufficient for us.

P.S. I saw an article yesterday that many stores are already notifying customers that they will not give credit for critical items purchased during the COVID 19 crisis period. Those hoarders will be well-supplied with toilet paper and hand sanitizers for awhile.

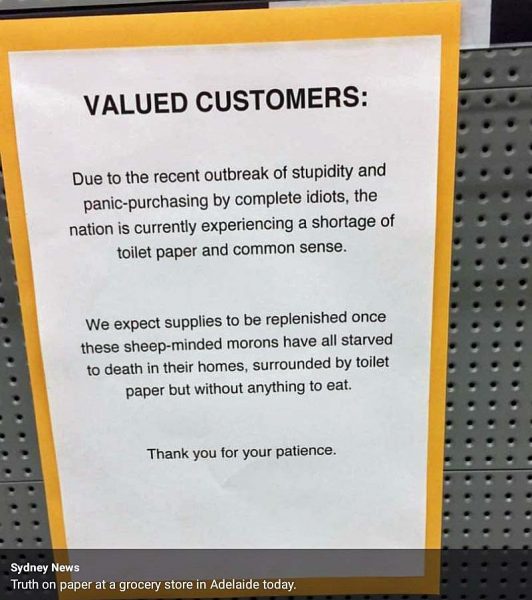

One of Ted’s Facebook friends posted this. It’s from Adelaide, Victoria (Australia.) I guess our local Target store isn’t the only place that’s out of toilet paper.

Shortages predicted to result from coronavirus-related production and shipping problems are causing people to horde supplies they think they will need. I’m not hoarding anything, but I get this, so I wasn’t surprised to see Wal-Mart’s shelves stripped of pain and fever-reducing medications, sterilizing mouthwash, and hand sanitizers. Yet, it seems like one product is being hoarded more than anything else.

That’s what Target’s toilet paper shelves looked like last night. Why are people hoarding toilet paper? One article I read suggested that buying lots of toilet paper might be making people feel like they have some control over the coronavirus, and therefore helps to calm them. If that’s true, there must be a lot of very calm people out there.

Ted and I made a Wal-Mart run and were surprised to see how many empty shelves there were in the store. Every department had gaping empty shelf spaces. Is the coronavirus affecting shipments and supplies? Are people buying and hoarding things faster than Wal-Mart can re-stock them? We don’t know, but it was a weird Wal-Mart shopping experience. Some of the empty shelves we saw were in groceries, . . .

kitchen utensils, . . .

pens and markers, . . .

pain-killing and fever-reducing medications, . . .

and germ-killing mouth washes.

I bought a shirt a few days ago, and noticed that the manufacturer has a clear mission statement on its tags.

Over the years, we’ve lost some trees to weather damage and needed to have them cut down. We simply had the tree company cut them down, grind them into mulch, and take the mess away. People living in one of the subdivisions adjacent to ours were more creative when they had two large trees removed from their front yard.

The long shot.

This was the tree on the left in the long shot photo, above.

And this used to be the tree on the right.

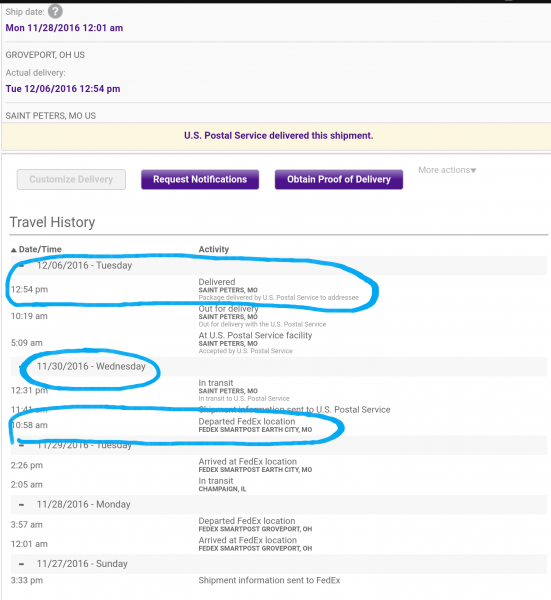

I was shopping on November 26 and found two long-sleeved shirts I liked. Unfortunately, the store did not have them in my size, but was willing to send them to my home via free shipping. I was told they have to say it will take 7-9 business days, but it usually arrives much sooner. My past experience has shown this to be true. Except this time.

I tracked my package and saw that the package was at the FedEx location in Groveport, Ohio on November 28 and arrived in Earth City, MO via Champaign, IL on November 29–a distance of 441 miles in about 14.5 hours. It left the Earth City location November 30, and my tracking record showed an expected delivery date from the Post Office on December 1. On December 2, Ted and I were near the local FedEx store (across the street from the St. Peters Post Office), so we stopped in to ask what was taking so long to get a package from Earth City to the St. Peters Post Office–a distance of 12.6 miles, according to Google Maps. The lady told me it was probably put in the wrong place on the truck and she’d have the driver look for it.

I was still waiting for the package on December 5, so I called FedEx Customer Service to see what was taking so long to get the package from Earth City to St. Peters. (Note that I remained very polite throughout the following telephone conversation.)

The FedEx customer service lady told me that if the tracking record says my package is in transit, it is on a truck, but since my shipper only paid for 7-9 day delivery, I shouldn’t expect it for 7-9 business days. I pointed out that if this is true, my package had already spent 4-5 business days on the truck (does FedEx do 7-9 day deliveries on Saturdays?), and that it seemed like a long time to drive it 12.6 miles, when I could have walked the distance in less than a day. I asked if it might have been put on the wrong truck or in an incorrect place on the right truck, and I was told again that since my shipper only paid for 7-9 day delivery, it would take 7-9 business days for my package to arrive. I asked if the driver was just going to leave my package on the truck until the 7-9 days were up, and if so, wouldn’t it make more business sense for FedEx to fill the truck with one-day deliveries than to use the gas to drive my package around for a week instead of unloading it? I was told that since my shipper only paid for 7-9 day delivery . . . (you get the drift).

Today, 8 business days later (if Saturday is a FedEx business day), using 6 business days to travel the final 12.6 miles, my package arrived–right on schedule.

You bet! Only six business days to drive my package 12.6 miles.

Two long-sleeved shirts, safely (and slowly) delivered.

It’s time for Dillard’s to empty the trash can. One helpful person attached a plastic bag to a straw in the trash can opening to accommodate additional trash. Yuck!

To (hopefully) bring a close to the ongoing saga of Schroeder vs. PNC Bank, I checked our credit rating with each of the three big credit score companies last week. All is well, so I’m satisfied with the result of my efforts. I am, however, still a little resentful that PNC didn’t simply correct their failure to file our paperwork, choosing instead to file a $50 lien against our house and report us as delinquent to the credit score companies. Would you believe that $50 reported delinquency took 125 points off our credit rating?!

After eight weeks of being nice and trying to work things out with PNC, on February 16, I reported them to the Federal Reserve, to the Missouri Attorney General, and to the Channel 4 investigative reporter. Channel 4 responded within an hour, the Fed responded in three business days, and the Missouri Attorney General sent us a letter on May 18 (very timely–not!) to say they had forwarded my complaint to PNC and were awaiting a response.

PNC had already met the Fed’s deadline for action on April 11, so the Attorney General’s action reached PNC more than a month after official resolution of the problem. This apparently irritated Andrea, the PNC Executive Client Relations Representative in Pittsburgh. Today we received a letter from her with copies of: her February 29 response to us saying she is happy to correct PNC’s error for us; her April 11 response to the Fed describing how her mess will be cleaned up; and her May 27 response regarding the Attorney General’s investigation.

The May 27 letter includes the phrases “PNC previously responded to your complaint,” “I have enclosed copies,” and “Thank you for allowing me to clarify.” The letter is very polite, but obviously has an undertone of disgruntlement. Well, too bad, so sad. I can’t help it the Attorney General took so long, and I was pretty frustrated myself for the eight weeks I tried to play nice with PNC. How does it feel to be on my end, Andrea?

It ain’t over ’til the fat lady sings. –Yogi Berra

Yesterday we had an email from the Consumer Financial Protection Bureau (CFPB) about our problems with PNC Bank. The bank has notified the CFPB that they have cleaned up their error (failing to file our paperwork) and the accompanying mess they made (keeping the account open, charging account fees and late fees, assessing a lien against our house, and notifying the credit bureau that we were delinquent on the account).

Question 1: How could we be delinquent on an account that we closed?

Question 2: Since I brought the whopping $50 error to their attention and filed duplicate paperwork on the same day I received the bill for the account fee, why didn’t they just work with us to correct the simple paperwork error instead of reacting like we’d committed the Financial Crime of the Century?

Question 3: Isn’t it amazing that they “misplaced” the paperwork we signed on December 23 (the PNC letter doesn’t mention the original paperwork we signed on September 1), but “found” it and processed it on January 27, just five days after being contacted by the CFPB? Hmmm . . . a little authorized clean-up going on inside the bank to cover their backsides?

PNC’s letter to the CFPB indicates that they have “instructed” the credit agencies to “remove all references for a delinquency” on the account. Literally, that doesn’t mean the credit agencies have restored our credit rating. I called the CFPB about this syntactical detail and Maria suggested I make use of my legal right to a free annual credit check with the three major credit agencies. If I am unsatisfied with the result, I may contact the CFPB and dispute the action of PNC within the next 60 days.

As I said before (March 1), in PNC’s place, I wouldn’t want to mess up an action that’s being monitored by my federal oversight agency. Yes, I think that’s the fat lady singing. Tra la la!

Thank you, PNC Bank (not!), for totally messing up our credit. We’re still waiting for the report that our credit rating has been repaired after the mess following PNC’s failure to process the paperwork we completed to close the account last September. Thanks to their error, they reported us to the Credit Bureau as delinquent. (They have until May 11 to fix that.)

Today, I got a phone call informing me that “one or more” of my “financial agencies” has reported that I am “eligible” for a debt consolidation loan. (The only debt we have is our monthly credit card bill, which we pay in full every month.)

I suppose now we’ll get calls from every cheesy debt consolidation company–all because of a $50 fee that we never owed. And, even though we paid off my car loan several years early, PNC was apparently eager to report us as “delinquent” for their minor $50 error, rather than simply correcting the error when I pointed it out to them. Never, never bank with PNC!!!

Ted and I each have a Citibank credit card and we’ve always been impressed with their security. Once, we went on a huge shopping spree and spent a lot more than usual in one day. At one point, my card was refused for possible fraudulent use and the store clerk put me on the phone to speak with the Citi person. I had to answer my security questions and verify that the purchases made that day were actually made by me.

Once or twice over the years, both Ted’s and my cards have been used in some unknown “suspicious” manner, and we were immediately called, texted, and emailed, and told about the activity. If we verify the activity, all is well; if not, we get a new card within two days.

Tonight, I received the multiple notifications that my card had been suspiciously used. Citi noticed that I charged groceries and movie tickets in Missouri today, and then attempted to charge a taxi in New York. It sounds like fun to be in New York, but I’ll settle for the new credit card that will arrive in two days.

Now I’m puzzled about how my “secure” chip credit card number was copied.

Right on schedule, I received an email message today from the CFPB (Consumer Financial Protection Bureau of the Federal Reserve) to inform me that PNC Bank has reported partial completion of the resolution of our complaint. PNC has an additional sixty days to resolve the matter fully, and the CFPB will notify me whenever they receive information from PNC.

The first unexpected bill from PNC arrived December 23, and I went to the bank that same day to correct the problem. Note that I signed paperwork that day and was told everything was resolved. This was followed by contacts from PNC once or twice weekly for the next eight weeks, each indicating (to me) that resolution had not been achieved after all. At the close of every contact, however, I was told that the situation was definitely resolved this time.

They were certainly a busy little bank while they were clearing up this problem! Even though the calls and letters from PNC stopped after I reported them to the Federal Reserve, the MO attorney general, and the media, they not only kept the account open, but put a lien against our house and reported the account as delinquent to the Credit Bureau. Amazing! I wonder how they define resolution.

Since the CFPB’s intervention, we’ve received letters from PNC thanking us for allowing them to resolve the problem. Really??!! Is that as opposed to suing them for emotional distress as a result of their error? Not to mention a large chunk of my time! PNC has informed us, and presumably the CFPB as well, that the line of credit has been closed, the fees have been waived, the balance due is $0.00, and the lien against our property has been removed. I believe we are now waiting for the Credit Bureau to “repair” (PNC’s word) our credit rating.

Next chapter due in sixty days or sooner.

Andrea called me back today. She works in the Executive (get that!) Client Relations Department at the Pittsburgh corporate headquarters of PNC Bank. She said the call was in reference to the complaint I filed with the CFPB (Consumer Financial Protection Bureau of the Federal Reserve Bank). Yea! Further proof that my tax dollars are doing some good.

Andrea admitted the bank made an error in processing the paperwork to close our line of credit, and she told me I should not be receiving any more calls. (Like I haven’t heard that line before–eight times in six weeks!) I will be receiving a letter from the Credit Bureau indicating that our credit record has been corrected. (I knew that even if it was a bank error, receiving calls from the collections department meant our credit rating would take a hit.)

I will also receive a letter from the bank telling me that the line of credit is closed and all charges have been waived. The catch? The letter must first be approved by PNC’s legal department and again by its claims department. This might cause the letter to be delayed beyond the CFPB’s deadline of March 11. If that happens, I will receive a letter explaining the reason for the delay. I assume the CFPB will receive a similar explanatory letter. In Andrea’s place, I probably wouldn’t want to send that letter without a really solid reason for missing the deadline of my federal oversight agency.

What a lot of fuss because someone didn’t file the paperwork we signed! Or is it? Ted and I can’t help thinking that, all along, this may have been a ploy to get us to pay the $50 fee just to make the hassle go away. Fifty dollars times x number of bank customers equals. . . . My words of wisdom? (1) Don’t bank with PNC; and (2) the CFPB rocks!

It isn’t over until the fat lady sings, but I think the orchestra is warming up.

Mike Columbo, the Channel 4 investigative reporter, called me this morning to let me know that they were going to run the segment about my problems with the bank on tonight’s five o’clock news.

When I first contacted Mike, I didn’t expect him to respond, and I never thought my problem would be dramatic enough to actually air the report. I was amazed to see that “my” segment was the lead teaser for the newscast and that the segment ran a full four minutes! Mike and Eric (the cameraman) did a wonderful job of making me look good, and I didn’t say anything stupid. It was even a good hair day for me!

Tonight, Ted and I went to a movie, and I was a little worried about being mobbed by groupies and autograph hounds, but it wasn’t a problem. Probably because I wore my contacts for the interview, but I had my glasses on tonight. The disguise worked and we were able to watch the movie in peace. Whew!

Back to business, the lady from the bank’s corporate headquarters left me a voice message two days ago, asking me to call her. I’ve left her two messages, but she hasn’t called back. I’m not convinced the matter is settled, so I’ll wait to see what the bank tells the CFPB–my new federal government best buddy.

Yesterday, the Consumer Financial Protection Bureau (CFPB) of the Federal Reserve emailed me to say they had contacted the bank and forwarded my complaint to them. Today I had a call from Andrea in the Executive Client Relations Department of the bank’s corporate headquarters in Pittsburgh.

We were at a movie until after 4:00 pm today, so Andrea’s office was already closed for the day (Eastern time zone) by the time I returned her call. I left her a voice mail. When/if she calls me back on Monday, will she tell me the matter has been resolved and the line of credit is finally closed? If she does shall I believe her? Given my history with the bank, I think I’ll insist on written confirmation.

In the ongoing saga of Schroeder vs. The Bank, I filed complaints with little expectation of action, especially from the state and federal government agencies. Surprisingly, after only three days, the Federal Reserve actually read my complaint and forwarded it to the Consumer Financial Protection Bureau (CFPB).

Today, four business days after that, I received an email from the CFPB saying they have contacted the bank and forwarded my complaint to them. Within 15 days, the CFPB will contact me to inform me of any action the bank has taken or will take to resolve the problem. Meanwhile, I can track the progress of my complaint online. Who would have expected such direct and timely action from the Federal government on such a relatively minor complaint? My tax dollars are apparently hard at work. (Or it’s a really slow week at the CFPB.)

With Channel 4’s (i.e., media) contact yesterday and the CFPB’s (i.e., federal government oversight) contact today, I’m feeling hopeful that the situation will be resolved very quickly and without (figurative) bloodshed.

This morning, I received a follow-up call about the travel club presentation we attended. The conversation went like this.

Lady: You attended a travel club presentation last week. Do you remember that?

Me: Yes. (Yes, I can still remember things that happened as long as five days ago.)

Lady: What did you think of the presentation?

Me: It was interesting. (But not in the way it was meant to be interesting.)

Lady: Were the people presenting the information courteous and friendly?

Me: Yes.

Lady: Did you sign up for the travel club?

Me: No. We wanted to check it out some more.

Lady: What could we do to make the presentation better?

Me: You could settle the lawsuit asking that the company cease and desist operating in Missouri. (Expecting to hear a disconnecting click.)

Lady (without missing a beat): OK, I’ll make a note of that. Thank you very much and you have a great day.

Today the Channel 4 investigative reporter, Mike Colombo, and his cameraman, Eric, came to the house to film an interview with me about the problems Ted and I have had trying to close our line of credit at the bank. It was pretty low-key, but Mike was duly impressed with my documentation. He mentioned several times that I could be useful as an investigative reporter. Not likely to happen, but a nice compliment anyway.

Eric selected the kitchen table for the interview. Afterwards, he spent about five minutes filming me from different angles while I “examined” my pile of documents. They spread the documents out on the table and took photos and video of them, and then they asked to take pictures of the car–the reason for opening the line of credit. From our house, they headed to the bank to take exterior pictures of the scene of the problem.

I asked what the next step will be, and Mike said the producer will call the bank’s media department to inform them of what’s going on. From that, they will probably be told whether or not the account has actually been closed. If not, we might be going on-air.

I’ll be thrilled if this whole mess just gets settled by the bank and I’m never on TV at all. We should know soon.

Interview in progress

Budding TV star with investigative reporter, Mike Colombo

When we bought my car, we took out a home equity line of credit to pay for it. We made the final payment six months ago and closed the account. Or so we thought. Since December 23, the bank has contacted me 11 times to tell me we have a balance due, including late fees, for the maintenance charge to keep the account open. Each time, I tell the same story and, each time, I’m told that the issue is resolved and I won’t receive any more bills or calls. Not true!

Well, the bank picked the wrong person to mess with! I documented every encounter! Last week, after “resolving” the issue yet again, I decided that if I was contacted one more time, I was going into action. I only had to wait two days for the next call. I politely explained the situation (again!) and said I would be filing complaints with the Federal Reserve and the state attorney general as soon as I hung up. (I’d already checked online to see if this was a viable thing to do.)

I filed official complaints with both. The Fed sent a follow-up message today, saying that my complaint has been reviewed and forwarded to the Consumer Financial Protection Bureau for action. (Pretty quick action for a federal agency!) Since nothing strictly illegal has been done and the complaint is basically about harassment, I don’t really expect any action from either agency. It just gives me satisfaction to file a formal complaint with the legal entities that oversee the bank.

Today, Ted and I each received a letter from the bank (it was only a single account) offering to work with us if our financial circumstances are making it difficult to pay the overdue charges!!! I decided I’m finished talking to the bank. Let them take us to court. But meanwhile, . . .

Next step: contact Channel 4’s consumer advocate. (Hey, why not?) Again, it’s only harassment and we haven’t been cheated out of anything, so I didn’t expect a response. An hour later, the reporter called, wanting to interview me tomorrow. I can’t do it tomorrow, so he’s coming to the house the next day.

Hopefully, one of two things will happen: (1) my stated intention to contact the Fed and the attorney general scared last week’s bank person into doing some paperwork; or (2) a call from the media will embarrass a different bank person into doing some paperwork. I don’t really want to be on TV. I just want to close a paid-in-full account. How hard can that be?

We attended yesterday’s travel seminar for two reasons: (1) We were curious what they’d have to say; and (2) we wondered if we’d really get a major prize without spending any money. We assumed we’d only get a gift if we signed up for a trip, and we had no intention of spending a dime. It was a surprise to be handed a folder with the details related to our Caribbean cruise.

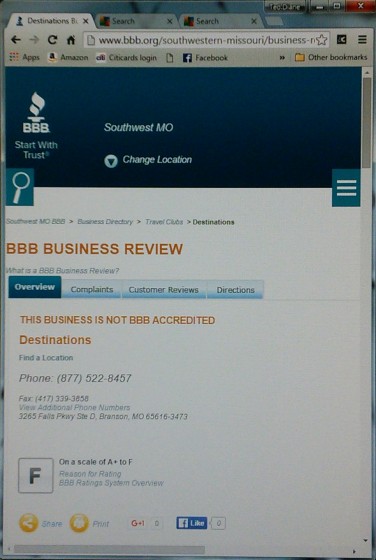

Today, Ted looked the company up online–again, out of curiosity, since we have no intention of joining their travel club–and it only took a moment to discover that there is a pending lawsuit against VSA Travel Clubs and its Missouri chapter, Destinations. The lawsuit requests that the company cease and desist operating in Missouri because of the large number of complaints and lawsuits filed against it. Here’s how the BBB rates VSA Destinations:

Ted also read the information we were given about the cruise. (I’m busy reading a novel, which is more interesting!) The cruise might be equally scam-like. Within two weeks, we need to send the $200 and select a date to cruise. We suspect the $200 cost will turn out to be a deposit on a full-price cruise. Oh, well, the Caribbean is way down on our travel list anyway–and the $10 in cash we received from the travel folks plus a $4-off coupon from the restaurant bought us lunch today.

We attended a sales pitch seminar for a wholesale travel company today, partly out of curiosity and mostly because we were promised a high-end gift just for attending: a 50-inch plasma TV, a Caribbean cruise, or an iPad, as well as a possible “bonus” prize of a $100 Wal-Mart gift certificate. We figured we’d have to sign up for some travel (not a chance!) to get the gift, but we decided to go anyway.

With a membership in this travel club, we can get unbelievable savings on unlimited upscale travel, including condos, hotels, cruises, air fare, tours, et al. The cost to join the club is a one-time bargain (?) payment of $12,999 plus a $286 service fee plus a $59 quarterly membership fee. Apparently, we can save more than that on our first two major trips. Even better, the membership can be willed to one of our children so that when we die, our child will have these awesome travel deals for the cost of the quarterly $59 fees. When we said we couldn’t commit to that without time to think it over, the price instantly dropped to $3,499 plus fees if we handed over a credit card immediately.

It was a fairly interesting presentation, but it brought to mind two major financial cautions: (1) If it seems too good to be true, it probably is; and (2) be suspicious if the price is good only at this moment. We said we still wanted to think it over, so the “closer” guy came over to talk with us–also unsuccessfully. Surprisingly, they were very polite and we didn’t feel strong-armed.

A third person then took us to the desk to “sign you out” and we got to draw for the Wal-Mart gift certificate. We won $10 in cash, but then we also got a Caribbean cruise! It won’t be free but, at first glance, it looks like it will be only $200 each for a seven-day cruise, which is pretty good for spending two hours at a sales pitch.